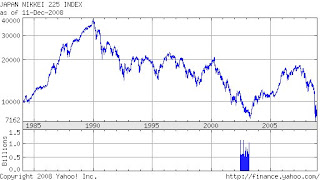

In 1990, Japan suffered a massive financial crisis. Their banks had been involved in profligate lending, resulting in a housing boom. Then after an all time high on December 29, the Nikkei crashed. Housing prices began to slide and Japanese banks were left holding billions in non performing assets. This caused a banking collapse that spread into a recession.

The Japanese response to the crisis was, at first denial, and then a reluctance to intervene. However, Japan also tried all the measures the US is contemplating, lowering interest rates, fiscal stimulus, tax cuts, etc. The result:

In this article, the authors argue that the real culprit was not the actions taken by the Japanese government, but the relative inaction, the changes were slow, and there was reluctance to make large enough bets (i.e. relatively tight fiscal policies) that have caused the subsequent gloom. This view is echoed by the consensus opinion of economists as illustrated here. And, in this article, the current actions taken by the US government are compared to actions by the Swedish government (only much more accelerated), and the Swedes did get their act together.

Having said all this though, the lesson that Japan holds for us is that while there are a plethora of opinions on what the right thing to do is, if mismanaged we could see a very long and hard route to recovery.

No comments:

Post a Comment